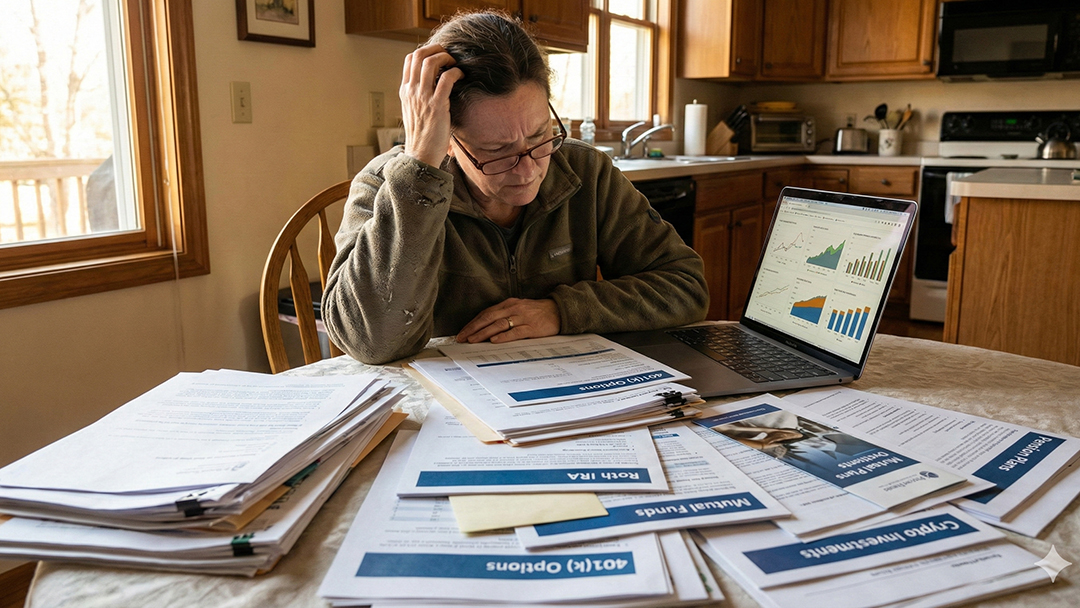

Planning for the future can feel overwhelming, especially when pensions, investments and long-term finances seem wrapped in complicated language. But the truth is this: whether you’re in your 20s, 40s or approaching retirement, understanding how your money works today can make a huge difference to the life you live tomorrow. This guide breaks everything down simply, so you can take control of your financial future with clarity and confidence.

Why Your Future Self Will Thank You

Most people underestimate how much income they’ll need later in life — and how long retirement actually lasts. With people living longer and the cost of living continuing to rise, relying on the State Pension alone won’t provide a comfortable lifestyle. Starting early, even with small amounts, gives your money time to grow. The earlier you begin, the less effort you need to put in later.

Understanding the Different Types of Pensions

State Pension

This is paid by the government once you reach State Pension age, as long as you’ve built enough National Insurance contributions. It provides a foundation but is rarely enough on its own.

Workplace Pensions

If you’re employed, you’re likely to be automatically enrolled. You pay in a percentage of your salary, your employer adds their own contribution, and you receive tax relief. It’s essentially free money many people don’t realise they’re missing out on.

Private Pensions / SIPPs

These give you more flexibility and control, especially useful for self-employed people or anyone who wants to supplement their workplace pension. All pension contributions benefit from tax relief, meaning your pot grows faster than you think.

How Much Should You Aim For?

A simple rule of thumb is the “half your age” rule — if you start at 30, aim to save around 15% of your income (including employer contributions). At 40, aim for 20%. These aren’t strict rules, but useful prompts to check if you’re roughly on track. Several pension providers offer calculators to help you see whether your current contributions will support the lifestyle you want in retirement.

Investment Basics: What You Need to Know

Investing isn’t gambling — it’s ownership. You’re buying small pieces of companies or assets that have the potential to grow over time. Shares, bonds, funds, index funds and property all offer different opportunities. A mix of them, known as diversification, helps steady your returns over the long term.

Pensions Are Investments — Here’s How They Grow

Your pension contributions don’t just sit as cash; they’re invested in funds designed to grow over time. This is why starting early is powerful — compound growth does the heavy lifting. Over decades, even modest contributions can grow into a meaningful, supportive pension pot.

Understanding Risk Without Fear

Every investment carries some level of risk — but risk isn’t always a bad thing. In fact, it’s necessary for long-term growth. Generally, younger people can afford to take more investment risk for higher growth potential, while those approaching retirement may choose lower-risk options to protect what they’ve built. Being overly cautious can actually harm your future finances by limiting growth.

The Tax Benefits You Shouldn’t Miss

Pension contributions receive tax relief, meaning the government effectively boosts your savings. ISAs also offer valuable advantages, allowing tax-free growth and withdrawals. Many people benefit from having both a pension for long-term retirement planning and an ISA for medium- to long-term flexibility.

Common Mistakes People Make

Starting too late, leaving pension pots untouched for years, not checking fund performance, staying in cash instead of investing, missing employer-matched contributions and forgetting older pension pots are all common pitfalls. A simple annual review can make a significant difference over time.

What the Recent Budget Means for Pensions and Investments

The latest Autumn Budget introduced several changes affecting pensions and investments, including adjustments to tax thresholds, salary-sacrifice rules and investment taxation. With higher taxes on savings and investments for many people, now is an ideal time to review your financial plan, check contributions and ensure your investments align with your goals.

How to Take Action: Simple Steps You Can Do Today

Check your pension contribution level, review your employer match, log in to your pension portal to assess fund choices, set up or increase ISA contributions, track old pension pots and consider advice from a qualified financial professional. Small steps now can have a major impact later.

Final Thoughts: Your Future Is Built Today

Understanding pensions and investing doesn’t need to be confusing. With a few key principles and consistent habits, you can take control of your financial future and build a life that gives you freedom, security and choice. Your future self will thank you for the steps you take today.

0 Comments