UK Pensions: State Pension Age Review and Inheritance Tax Shake-up

The UK pension landscape is once again in the spotlight, with two major developments sparking debate among financial experts, policymakers, and the public. A government review could see the State Pension age rise to 70, while controversial tax reforms will soon subject pension pots to inheritance tax for those who die before the age of 55. Both changes highlight the growing tension between financial sustainability and fairness in retirement planning.

State Pension Age Under Review

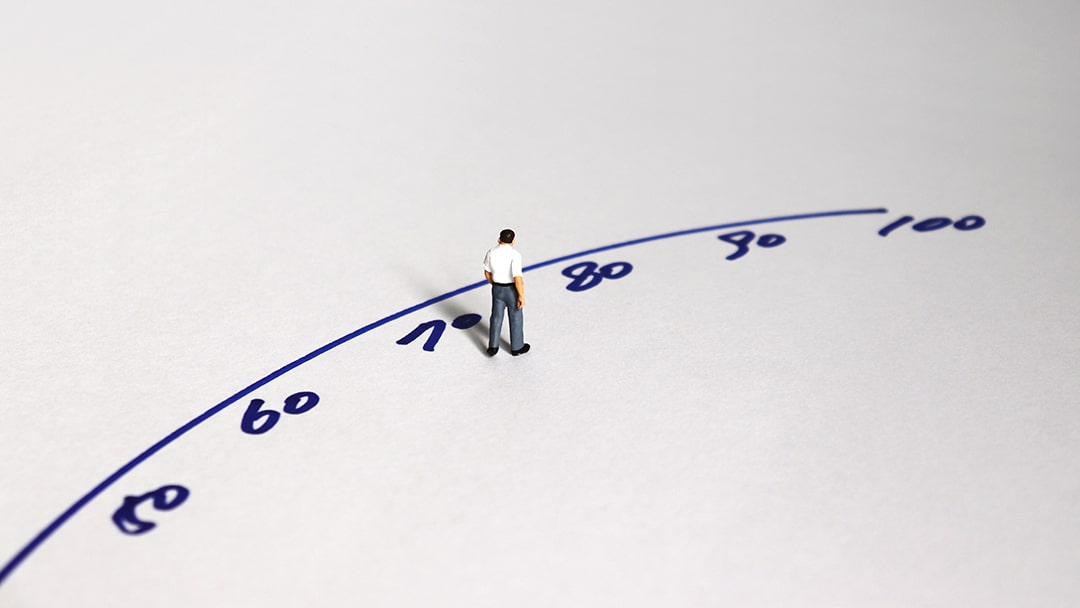

The State Pension has long been seen as the cornerstone of retirement security in the UK. Currently set at 66, with gradual increases already scheduled, a new government-commissioned review is exploring the possibility of raising the pension age to 70. The main justification lies in rising life expectancy and the pressure it places on public finances. With people living longer, pensions must stretch further, and the Treasury is keen to balance sustainability with affordability.

However, critics argue that this shift could unfairly impact those in physically demanding jobs or individuals in poorer health, who may not live long enough to benefit fully from their pension. While the government frames the review as a necessary step to future-proof the system, many see it as pushing retirement further out of reach for ordinary workers.

Inheritance Tax Reform on Pensions

From April 2027, a new rule will impose inheritance tax (IHT) on pension pots left by individuals who die before the age of 55. Previously, pensions passed on tax-free if death occurred before that milestone. The change has already been labelled “unbelievably unfair” by financial commentators, as it penalises families during what is often a time of tragedy.

For those who pass away young, the new rule risks reducing the financial support available to their loved ones, despite years of responsible saving. It also raises questions about the purpose of pension planning if funds can be eroded before they are ever accessed. This reform is seen by many as a cash grab at the expense of grieving families.

What Does This Mean for You?

For savers, these changes highlight the importance of proactive planning. If the State Pension age does rise to 70, younger generations will need to take greater responsibility for their own retirement security—relying more heavily on workplace pensions, private investments, and ISAs. Meanwhile, the inheritance tax shift underscores the value of holistic estate planning, ensuring that families are not caught out by sudden tax bills.

Looking Ahead

The debate around pensions is ultimately about balance: between fairness and sustainability, between individual responsibility and government support. While longer lives are something to celebrate, the financial implications cannot be ignored. Both reforms are likely to face intense scrutiny in the months ahead, but one thing is certain—UK pensions are entering a period of significant change, and those who prepare early will be best placed to weather the storm.

0 Comments