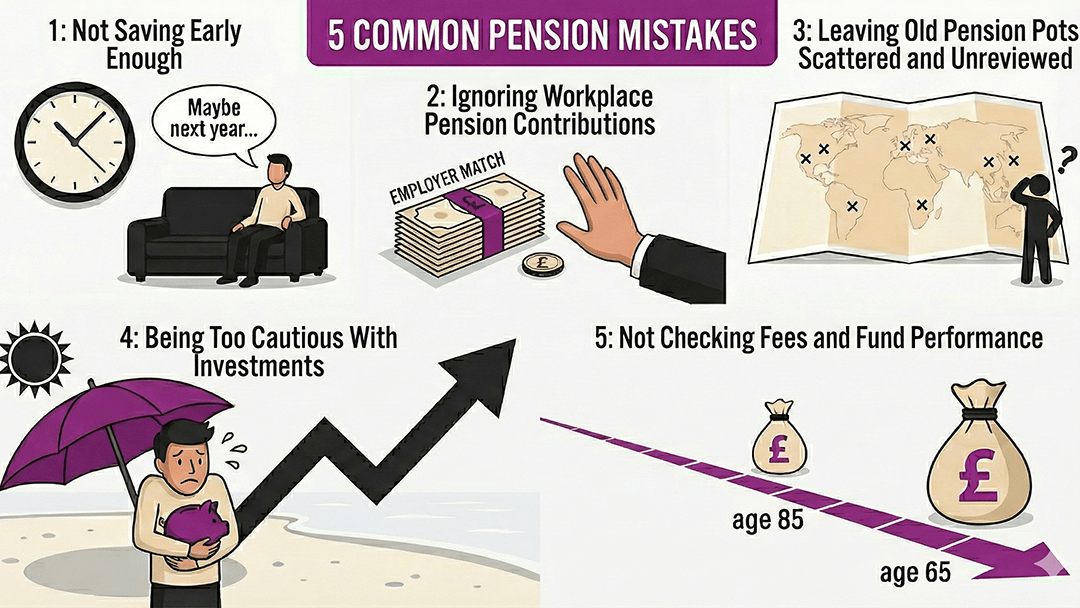

Understanding your pension is one of the most important parts of planning for a secure future, yet many people unintentionally limit their retirement income through a few very common mistakes. The good news is that each one of these issues is easy to fix once you know what to look for. Here are the five biggest pension mistakes people make, and the simple steps you can take to avoid them.

Mistake 1: Not Saving Early Enough

Many people postpone pension contributions because retirement feels too far away to worry about. The problem is that delaying even by a few years means your pot misses out on valuable compound growth. The earlier you start contributing, even in small amounts, the more time your money has to grow. Starting early is one of the easiest ways to build a stronger pension without dramatically increasing your monthly contributions later in life.

Mistake 2: Ignoring Workplace Pension Contributions

Workplace pensions are one of the most generous benefits available to employees, yet many people don’t take full advantage of them. When your employer contributes to your pension, you’re effectively receiving free money. If your employer matches contributions up to a certain percentage, it’s worth aiming to meet that level. Failing to do so means missing out on money you’re entitled to and losing long-term investment growth.

Mistake 3: Leaving Old Pension Pots Scattered and Unreviewed

Most people change jobs several times throughout their career, often leaving behind small pension pots with previous employers. These pots can easily become forgotten, underperform, or remain invested in funds that no longer suit your goals or risk level. Reviewing old pensions and considering consolidation (where appropriate) helps you stay organised, reduce possible fees, and ensure all your retirement savings are working efficiently for you.

Mistake 4: Being Too Cautious With Investments

While protecting your pension pot is important, being overly cautious can significantly limit long-term growth. Younger savers, in particular, can afford to take more investment risk because their pension has decades to recover from short-term market fluctuations. Sitting in low-risk funds for too long may feel safe, but it often means your money isn’t growing enough to keep up with inflation or meet your future retirement needs.

Mistake 5: Not Checking Fees and Fund Performance

Pension fees might seem small at first glance, but over decades they can make a significant difference to the value of your pot. Similarly, pension funds should not be left untouched for years without review. Regularly checking fees, performance, and whether your investments still align with your risk level can help you make informed decisions and keep your pension on track. A quick annual review can prevent long-term losses and ensure your money continues to grow efficiently.

Avoiding these common pension mistakes can make a meaningful difference to your financial future. By starting early, making the most of employer contributions, reviewing old pots, choosing the right investment approach and monitoring fees, you can build a pension that supports the lifestyle you want in retirement. Small steps today can create far greater security and peace of mind tomorrow.

0 Comments