by admin | Dec 8, 2025 | Uncategorized

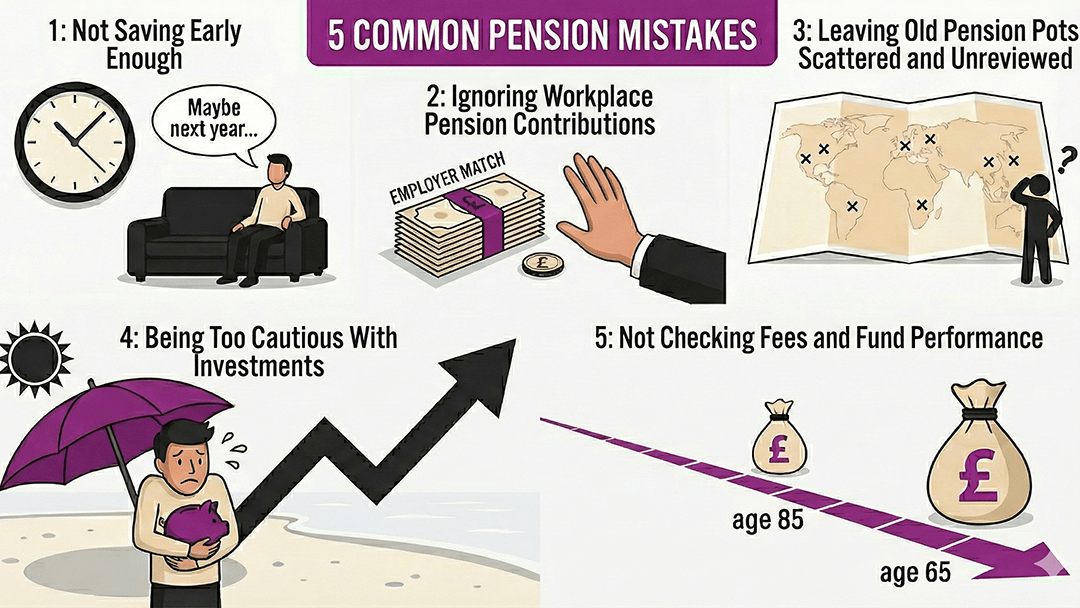

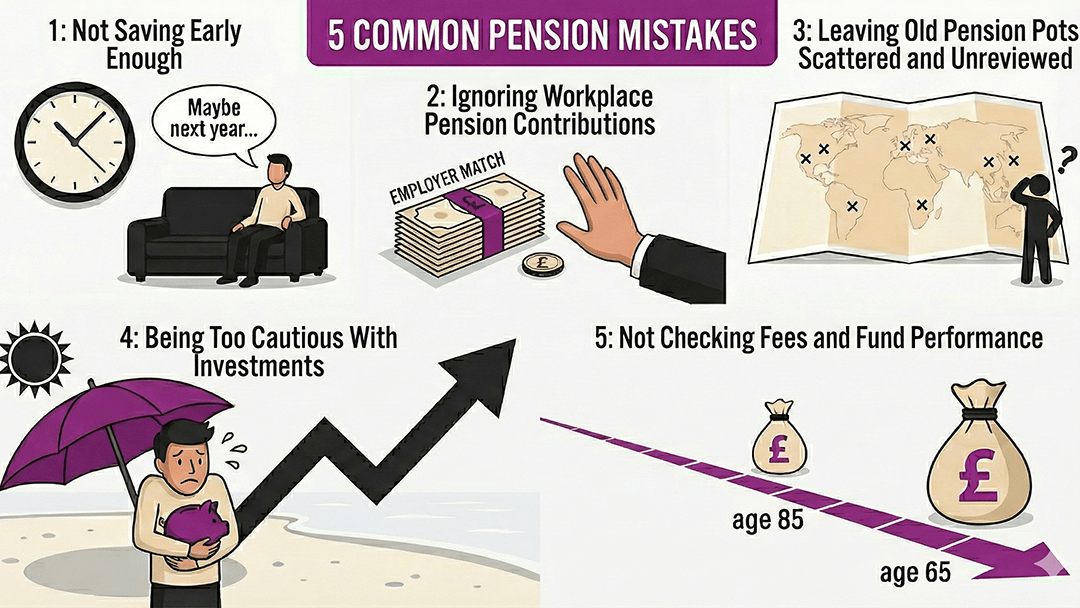

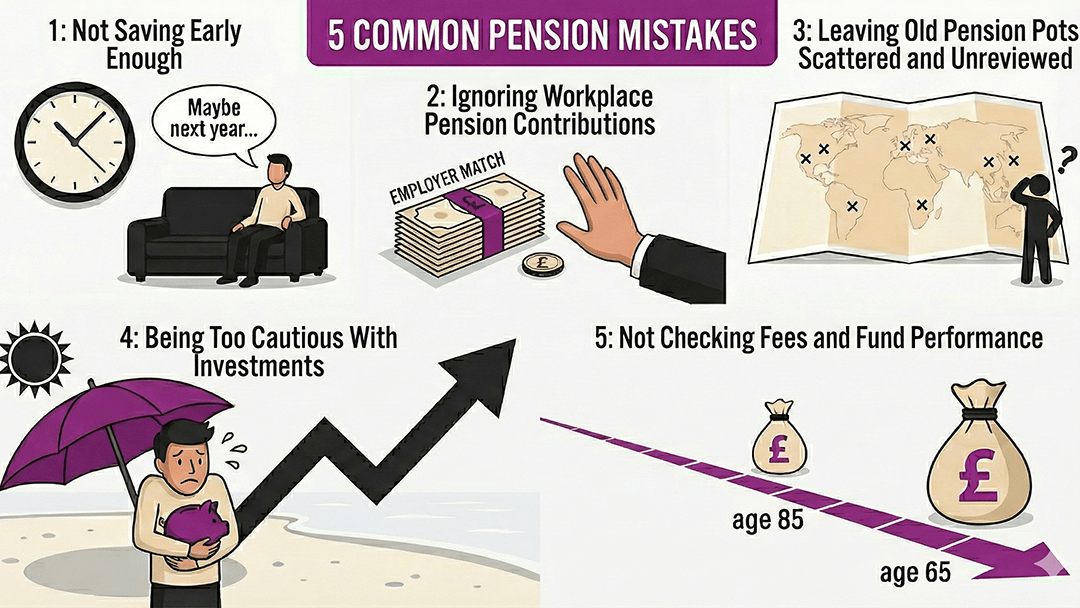

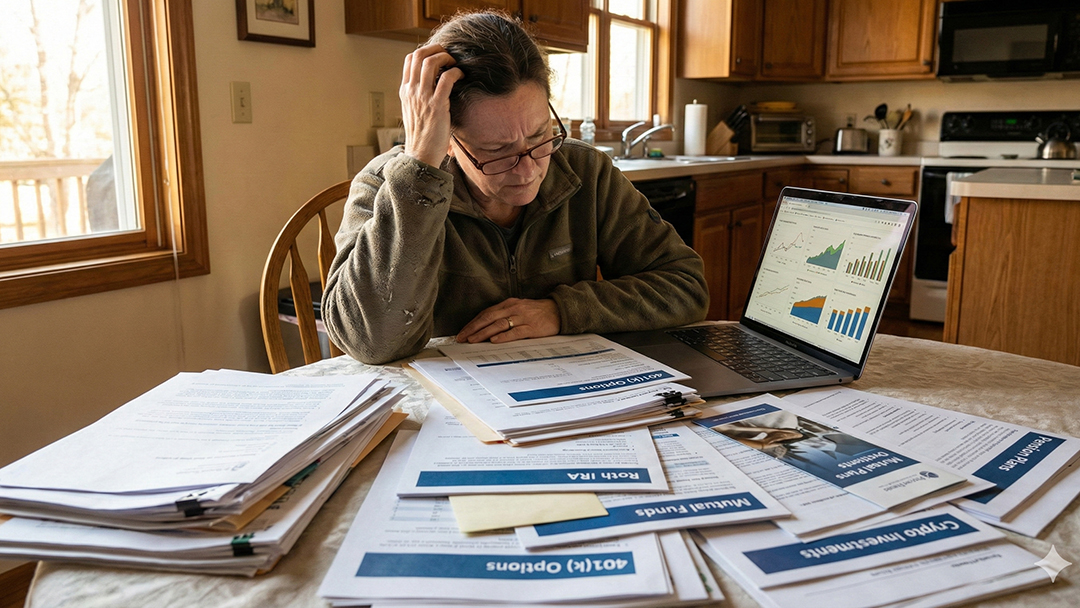

Understanding your pension is one of the most important parts of planning for a secure future, yet many people unintentionally limit their retirement income through a few very common mistakes. The good news is that each one of these issues is easy to fix once you know...

by admin | Nov 30, 2025 | Uncategorized

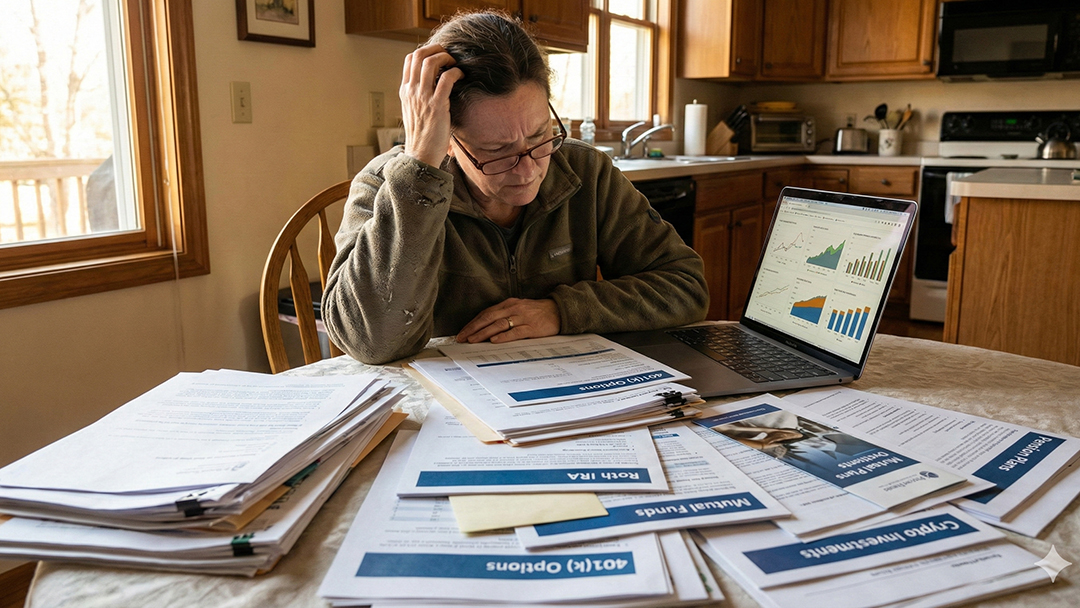

Planning for the future can feel overwhelming, especially when pensions, investments and long-term finances seem wrapped in complicated language. But the truth is this: whether you’re in your 20s, 40s or approaching retirement, understanding how your money works today...

by admin | Aug 31, 2025 | Uncategorized

What is Income Protection? Life can be unpredictable, and none of us know what’s around the corner. Income protection is designed to give you financial security if you are unable to work due to accident, injury, sickness or unemployment. It steps in when your income...

by admin | Aug 8, 2025 | Uncategorized

Remortgaging can be a smart way to reduce your monthly payments, secure a better interest rate, or release equity from your home. But if you have bad credit, you may worry that your options are limited. The truth is, while a poor credit history can make the process...

by admin | Jul 15, 2025 | Uncategorized

Understanding Debt Consolidation Debt consolidation involves combining multiple debts into a single, manageable loan. This approach simplifies repayments and can often reduce your monthly expenses. However, when considering consolidation, some people also think about...

by admin | Jun 24, 2025 | Uncategorized

After nearly a year of gradual rate cuts, the Bank of England has pressed pause, holding interest rates steady at 4.25% in June. Having dropped from a 15-year high of 5.25% since August 2024, this decision marks a turning point in the UK’s battle with inflation—and...